7 auctions show India’s RE sector is still primed for growth

By EPR Magazine Editorial October 3, 2020 2:09 pm IST

By EPR Magazine Editorial October 3, 2020 2:09 pm IST

While the pace of renewable energy growth has slowed in India, positive outcomes in recent auctions suggest there remains plenty of appetite among domestic and foreign investors to build renewable infrastructure, according to Institute for Energy Economics and Financial Analysis (IEEFA).

Policy-related headwinds and a collapse in electricity demand due to the COVID-19 crisis have disrupted India’s renewable energy capacity tendering and commissioning process.

But despite these setbacks, renewables are proving resilient with investment capital available for new projects with favourable risk-return profiles, says author Kashish Shah, Research Analyst at IEEFA.

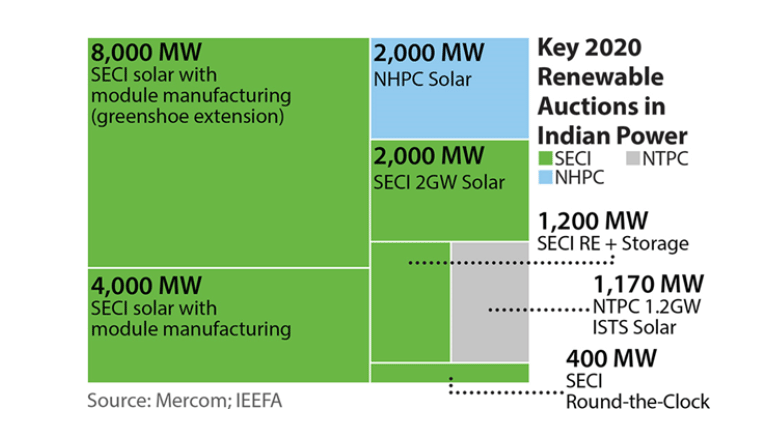

IEEFA’s note looked at the outcomes of seven renewable energy capacity and storage auctions held to-date in 2020. It found that together they attracted some US$10-20bn of investment commitments, despite the pandemic.

The note points to the Solar Energy Corporation of India’s (SECI) 2 GW solar auction in June as a particular highlight. It delivered India’s lowest-yet renewable energy tariff at Rs2.36/kWh (US$31/MWh) with zero indexation for 25 years.

Developers from around the world secured winning bids: Solarpack (Spain); Enel (Italy); Amp Energy (Canada); Eden Renewables (France); IB Vogt (Germany); Ayana Renewable Power (backed by the UK’s CDC Group); and ReNew Power (Indian, but backed by Abu Dhabi’s ADIA, Canada’s CPPIB, Japan’s JERA and the U.S.’s Goldman Sachs).

SECI’s June auction reflects 15% y-o-y deflation in solar module prices

“The cost competitiveness and continuing price deflation of renewable sources makes them a more viable energy generator than many existing thermal power plants, and all new import power plants,” says Shah. “Domestic and global investors are sitting up and taking notice of declining renewables prices plus the clear government policy alignment and ambition, and this is reflected in the very positive results of these recent auctions.”

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.