Duty passthrough to lift tariffs by 50-70p/unit for up to 6 GW of solar projects

November 29, 2022 10:43 am

November 29, 2022 10:43 am

The Ministry of New and Renewable Energy’s decision to treat the basic customs duty (BCD) on solar cells and modules as a “change in law” and allow for its passthrough could raise the tariff by 50-70p/unit of electricity2 for eligible projects. The increased tariff will remain well below the average power purchase cost for DISCOMs in India. However, more importantly, this announcement brings partial relief for up to 6 GW of solar projects that are already seeing elevated project costs as they are set to achieve COD or import modules this fiscal year.

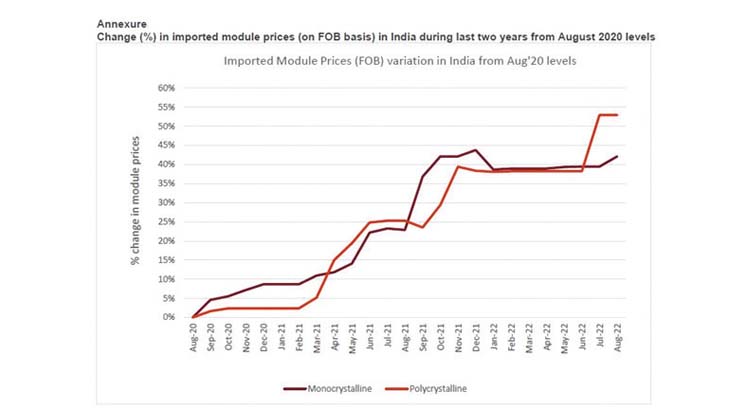

The solar power industry has already seen a sharp rise in module prices in the last two years. This has been further aggravated by the imposition of 40 percent BCD on the import of modules and 25 percent on the import of cells, effective April 1, 2022. Though the move is intended to encourage domestic manufacturing of solar modules and cells and reduce reliance on imports, it increased project costs by 25 percent, depressing developers’ already meagre returns.

The BCD imposition was likely to impact 17 GW of projects bid between October 1, 2019, and March 9, 2021. These projects were likely to procure modules after April 1, 2022, and could not have factored the customs duty into their bid tariffs.

Says Manish Gupta, Senior Director, CRISIL Ratings, “Based on our discussions with industry players, we estimate that for 50–60 percent of the 17 GW capacity, modules may be procured domestically, keeping it out of the ambit of duty.” For another 10-15 percent of such capacity, modules were imported before the BCD imposition. Hence, treating BCD as a “change in law” event will benefit the remaining capacity of up to 6 GW, making the projects economically viable.

These projects were bid at tariffs ranging from Rs 1.99/unit to Rs 2.92/ unit, with only 20 percent of the projects being at a tariff of more than Rs 2.55/ unit, thus the increased tariff post passthrough is expected to be in the range of Rs 3-3.2/unit, keeping them cost-competitive compared to average power procurement costs for DISCOMs in India.

Says Ankit Hakhu, Director, CRISIL Ratings, “Tariff pass-through remains only a partial relief as returns for these projects will remain weaker than envisaged at the time of bidding, as module prices have risen by 50 percent since then.” This is in contrast to the industry expectation of softening prices, in line with past trends, and was not budgeted in tariffs while bidding.

Timely approval by regulatory authorities pertaining to the tariff passthrough is essential to protect against further erosion of returns.

Announcement made by the Ministry of New and Renewable Energy on September 27, 2022.

2 Based on the prevailing rupee-dollar exchange rate (USD 1 = INR 83) and imported module prices.

Three imports account for 80–85 percent of India’s module supply. Four solar modules comprise nearly 60 percent of the project cost. 5 Mostly low double-digit or single-digit IRRs (at P75 PLF levels) due to aggressive tariffs quoted in the bids and increasing module prices the announcement date for the imposition of BCD on April 1, 2022.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.