Diesel genset market in India is at a crossroads

By Staff Report June 4, 2025 12:30 pm IST

By Staff Report June 4, 2025 12:30 pm IST

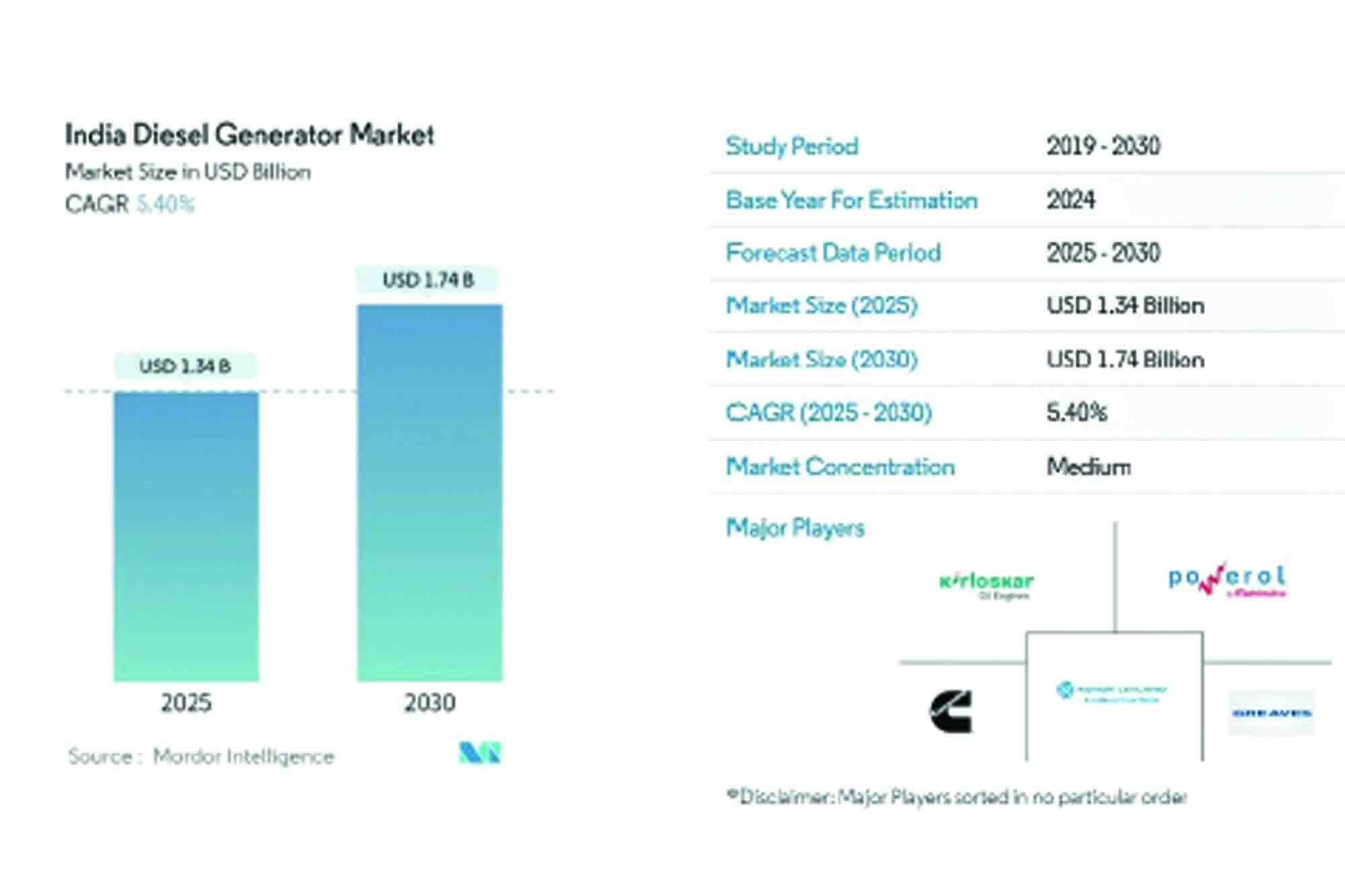

According to a report by Mordor Intelligence, the diesel genset market is projected to reach $1.74 billion by 2030 with a 5.4% CAGR, despite challenges from rising demand, regulatory pressures and a shift toward sustainable energy.

The Indian diesel generator (DG) market stands at a crucial juncture driven by the dual currents of rising power demands from industrial and infrastructure sectors and the intensifying push toward clean energy alternatives. Valued at an estimated $1.34 billion in 2025, the market is expected to grow to $1.74 billion by 2030 at a steady CAGR of 5.4 percent, according to a recent report by Mordor Intelligence.

The market’s evolution is marked by both opportunities and obstacles. While industrialisation, urban expansion, and infrastructure development continue to surge the demand for diesel generators across commercial and industrial domains, regulatory pushback and a shift toward sustainable energy sources pose significant challenges.

Industrial growth and infrastructure boom

The backbone of diesel generator demand in India lies in the country’s rapidly expanding industrial and infrastructure footprint. Diesel generators remain essential for industries requiring uninterrupted power supply, especially during outages or remote regions lacking consistent grid connectivity.

The manufacturing sector is set to reach $1 trillion by 2025–26, a major driver. Fuelled by investments in automobiles, electronics, textiles and pharmaceuticals and supported by government initiatives like ‘Make in India’, and the Production Linked Incentive (PLI) scheme, manufacturing hubs in Gujarat, Maharashtra and Tamil Nadu are propelling diesel generator usage.

Moreover, the Government of India’s infrastructure push is a critical growth vector. The past few years have witnessed remarkable milestones, such as the Atal Tunnel, the world’s longest highway tunnel, and the Chenab Bridge, the world’s highest railway bridge. Such mega-projects often operate in remote locations where diesel generators are the most reliable power option for machinery and construction equipment.

In September 2024, the Indian government unveiled plans to invest ₹3 trillion in metro rail projects to ease urban congestion and enhance connectivity. These projects are expected to increase the demand for diesel generators during construction significantly and as backup power units for station operations.

The commercial sector, which encompasses finance, real estate, healthcare, education, and hospitality, is also a significant end user. These segments demand backup power solutions to ensure business continuity during grid failures, especially in cities like Delhi, Mumbai, and Bengaluru, where infrastructure stress can lead to frequent outages.

Hybrid generator technologies

In response to evolving needs, diesel generator manufacturers in India are innovating to retain relevance in a market increasingly inclined towards sustainability. Hybrid generator sets integrating solar or gas with diesel are gaining popularity for their ability to reduce emissions and fuel consumption. Additionally, smart DG sets equipped with digital monitoring and predictive maintenance tools offer enhanced efficiency and operational insight.

Leading Indian DG market players such as Kirloskar Oil Engines, Cummins, Mahindra Powerol, Greaves Cotton, and Jackson Group are aligning with these trends. Greaves Engineering, for instance, launched CPCB IV+ compliant gensets in July 2024, compatible with cleaner fuels like biodiesel and ethanol. With capacities ranging from 5 kVA to 500 kVA, these gensets cater to commercial and industrial sectors looking to reduce their carbon footprints without compromising reliability.

Environmental regulations and renewables

Despite strong demand, the DG market in India faces substantial challenges from the increasing adoption of cleaner energy alternatives. Diesel generators, long criticised for their high emissions and noise pollution, are coming under greater scrutiny from policymakers and environmentally conscious businesses.

In recent years, regulatory bodies have taken firm action. The Commission for Air Quality Management (CAQM), in response to rising pollution in the Delhi NCR region, imposed a ban on large diesel generator sets in September 2023, exempting only essential services like hospitals and emergency response units.

Additionally, state-level mandates now often require emission control devices (ECDs) or dual-fuel kits to reduce particulate matter emissions from existing diesel generators. However, these solutions can be expensive, leading businesses to explore alternative energy options that provide both environmental and cost advantages.

Natural gas and solar generators

A key trend reshaping the backup power landscape is the gradual migration from diesel to natural gas and solar-based generators. A prominent example is Samsung India’s initiative in March 2024 to replace ten diesel generators at its Noida plant with eight natural gas-based units. The transition curbed carbon emissions and delivered considerable operational cost savings. A 20 MW gas-based genset now powers the plant’s emergency systems, showcasing a scalable model for other industrial consumers.

Solar generators, often paired with battery storage systems, are also gaining traction, particularly in the residential and small-business segments. In May 2026, EcoFlow introduced its DELTA 2 MAX solar generator in the Indian market. The product can store up to 2048 watt-hours and provide emergency power for up to two days, making it a compelling alternative for short-term outages.

According to government data from February 2024, the private sector accounts for a staggering 223 GW of installed renewable energy capacity. Government policies continue to drive growth in this space, from subsidies for rooftop solar installations to funding for large-scale solar and wind projects. These initiatives diversify the energy mix and aim to create employment opportunities, especially in rural areas.

Market in transition

The diesel generator market in India is expected to maintain positive momentum through 2030, underpinned by industrialisation, construction booms, and increasing demand for reliable backup power. However, environmental regulations and the expanding footprint of renewable alternatives will likely moderate the pace of growth.

The future trajectory of the diesel genset market will depend on key factors shaping the energy landscape. A stricter policy environment with tighter emission norms may suppress sales unless manufacturers pivot swiftly to cleaner technologies. Technological innovation, especially integrating IoT, AI and alternative fuels, could create new growth opportunities. Consumer behaviour is also shifting as businesses and homeowners increasingly consider long-term savings and environmental impact over initial costs. Ultimately, the pace of renewable energy adoption will play a decisive role in determining the relevance and role of diesel gensets within the evolving power ecosystem in India.

In summary, while diesel generators are far from obsolete in India, their role is being redefined. They are shifting from the default backup power solution to one of many options in an increasingly diversified energy landscape. To thrive, market players must invest in cleaner, smarter technologies that align with the country’s broader vision of sustainable development.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.