Bangladesh adopts rooftop solar to revamp energy landscape

By EPR Magazine Editorial January 20, 2024 10:47 am IST

By EPR Magazine Editorial January 20, 2024 10:47 am IST

New energy order focuses on rooftop solar, aims to cut costs, boost resilience, and reduce import dependence.

Bangladesh’s persisting energy sector challenges of more than one and a half years raise policy concerns and the need to spearhead a new energy order. The new order must focus on increasing renewable energy contribution and reducing demand through energy efficiency to make the country’s energy model more resilient and sustainable. The need for a new energy order is essential in light of the heavy financial losses of the Bangladesh Power Development Board (BPDB) in the fiscal year (FY) 2022-23.

Against such a backdrop, rooftop solar has the potential to play a central role alongside other clean technologies, especially in mitigating expensive power generation and purchase during the daytime, reducing the BPDB’s revenue shortfall. Pursuing rooftop solar is economically compelling for industries and commercial buildings. The new regulatory directive also requires new buildings to install rooftop solar systems to secure grid connections.

As of December 2023, the combined rooftop solar capacity installed under net-metered and non-net-metered systems reached only 162.73 megawatts (MW). This paltry rooftop solar capacity heightens the importance of fixing prevailing problems to accelerate the sector’s expansion.

Rooftop solar can help reduce the BPDB’s revenue shortfalls

Many of the BPDB’s problems emanate from its exorbitantly expensive power purchase from some private plants, which operate at a very low capacity. The obligation for capacity payments to such plants raises the overall costs, causing the BPDB to purchase power at a price 7 to 8 times higher than its bulk selling price. High prices of fossil fuels in the international market also affected the power sector in FY2022-23. Eventually, the financial loss reached Bangladeshi Taka (Tk) 117.65 billion (US$1.07 billion) in FY2022-23, despite a whopping subsidy of TK395.35 billion (US$3.6 billion) allocated by the government.

However, a significant rooftop solar capacity could allow the government to phase out some expensive power plants. A recent study by the Institute for Energy Economics and Financial Analysis (IEEFA) substantiated that a combined rooftop solar capacity of 2,000MW, if installed by industries and building owners, could help BPDB minimise power generation and purchase costs between Tk52.3 billion (US$476 million) and Tk110.32 billion (US$1 billion) a year. This is how BPDB can reduce its soaring revenue shortfall.

Upscaling rooftop solar requires fixing current problems

While rooftop solar installations surged in 2023, the present installed capacity of less than 200MW seems grossly inadequate. Interest among building owners remains scattershot. This is despite the tariffs that make rooftop solar lucrative for industries and commercial buildings. Among other things, lack of awareness of the benefits of rooftop solar, high import duties on accessories, perceived risks of financiers, capacity gap of sector stakeholders and lack of business models for utilities hinder the smooth uptake of rooftop solar in the country.

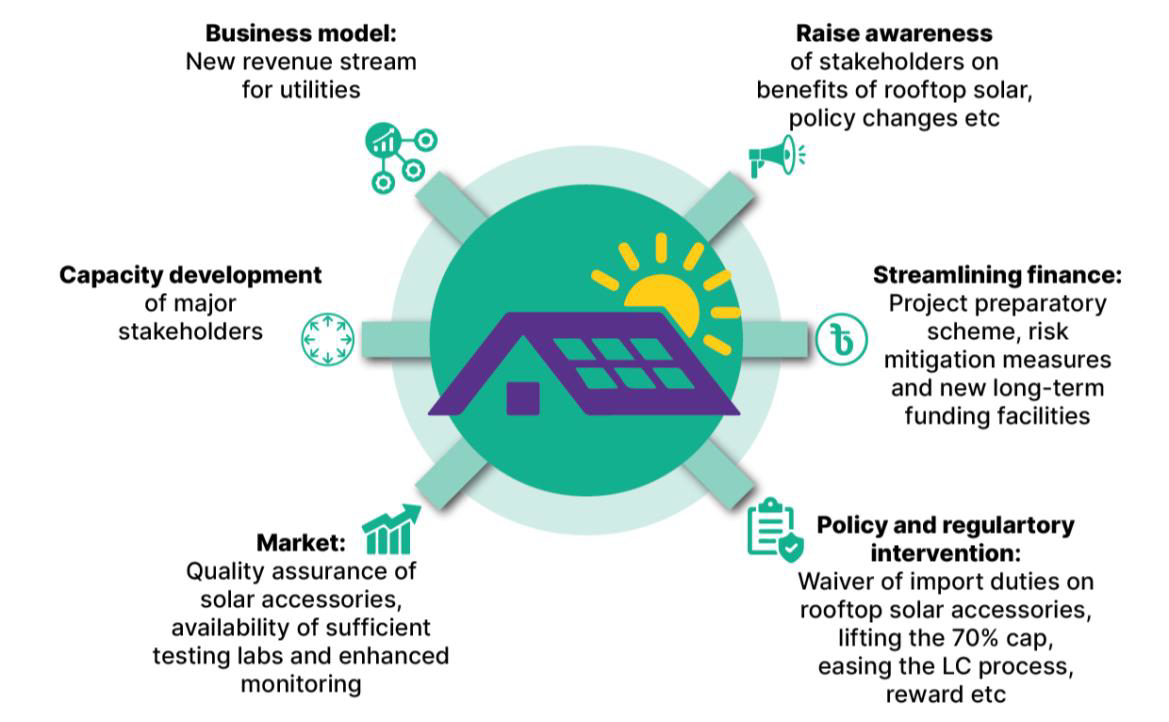

IEEFA’s recent study recommended six key levers to design Bangladesh’s market that incentivise and de-risk investments in rooftop solar.Raising awareness: This will help reduce information asymmetry within the sector and build the trust of stakeholders in rooftop solar intervention.

Streamlining finance: Perceived risks of financiers result in high collateral requirements, affecting the loan approval process. Risk mitigation instruments, such as a credit guarantee scheme, can help overcome this challenge. While the refinancing scheme of the Bangladesh Bank and the loan facility of the Infrastructure Development Company Limited (IDCOL) are attractive, local financial institutions would need to explore funding sources, including multilateral agencies, international climate finance and the local bond market, to meet the demand of the sector in the foreseeable future.

Policy and regulatory intervention: The prevailing high import duties, ranging from 11.2 percent to 58.6 percent on different accessories, disproportionately affect rooftop solar as opposed to utility-scale solar projects, which enjoy a full waiver of any such cost. Waiver of such duties will incentivise the rooftop solar sector.

Quality assurance: As recent changes in regulations compel new buildings to install rooftop solar to obtain grid connection, the number of small rooftop solar units will likely increase sharply, raising similar concerns about poor-quality installations that damaged confidence in the past. Therefore, adequate testing of solar accessories and market monitoring to drive out poor-quality equipment are indispensable.

Business models for utilities: With many building owners expected to install small rooftop units to comply with minimum solar targets for new grid connections, demand aggregation will be even more important for viability and quality assurance, and utilities will be an integral part of this. Utilities have little or no motivation to accelerate rooftop solar projects without business models that reward. Both the utility- and third-party-owned business models can be a source of revenue for utilities, incentivising them to multiply their efforts in the rooftop solar sector.

Capacity development of key stakeholders: Major stakeholders of the rooftop solar sector have limited capacity. Targeted programs will help develop the capacity of the key stakeholders of the sectors.

Bangladesh’s new energy order must address the challenges of import dependence that cause serious upheavals, including a rising subsidy burden. Rooftop solar can be central to such an effort and help enhance the BPDB’s resilience and reduce import dependence.

Authored by: Shafiqul Alam is a Lead Energy Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA)

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.