Liquidity infusion for DISCOMs: A welcome step for power generating companies

By EPR Magazine Editorial May 15, 2020 4:55 pm IST

By EPR Magazine Editorial May 15, 2020 4:55 pm IST

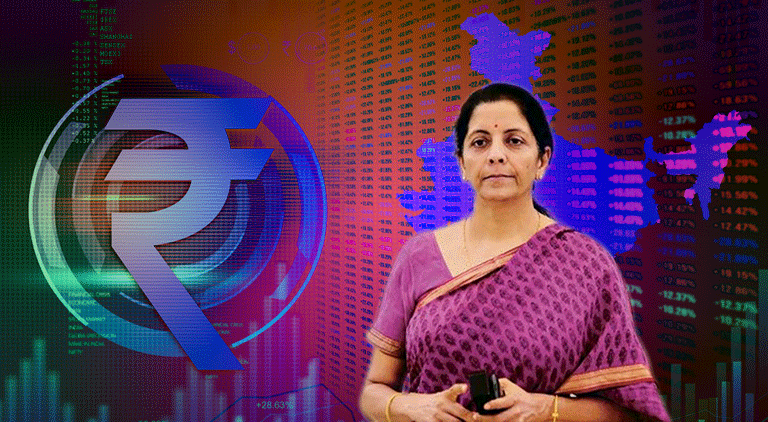

In light of COVID-19, Honourable Prime Minister Narendra Modi under the Aatmanirbhar Bharat Abhiyan package announced ₹20 lakh crore relief fund for India, which is around 10 percent of the GDP. At a press conference, Finance Minister Nirmala Sitharaman announced liquidity infusion of ₹90,000 crores for state power distribution utilities (DISCOMs) as one of the 15 measures to combat the economic effect of the coronavirus pandemic-induced lockdown, which has worsened the already precarious finances of these DISCOMs.

The liquidity infusion will be in the form of loans against receivables from Power Financial Corporation (PFC) and Rural Electrification Corporation (REC). The Finance Minister stated, “Power Finance Corporation and Rural Electrification Corporation will infuse liquidity in the DISCOMS to the extent of ₹90,000 crores in two equal instalments.” These loans will be backed by state government guarantees and will be used to clear the pending dues to central public sector power generation companies, transmission companies, independent power producers, and renewable energy generators. The announcement is a much welcome measure.

The dues of DISCOMs to power generation and transmission firms are to the tune of ₹94,000 crore. These loans will be disbursed in two tranches and linked to certain reforms in the state power sector such as promotion of digital payments from consumers, liquidation of outstanding dues from state governments, and plan to reduce operational and financial losses by the DISCOMs. Also, the central public sector generation companies have been asked to provide rebate through waiver of fixed charges and transmission charges to the extent of power not drawn by the DISCOMs, which is to be passed on to the final consumers by the DISCOMs. The detailed guidelines are awaited from the Central Government on the linkage of the loans to the implementation of reforms by the state government and DISCOMs.

This comes amid India’s proposed distribution reforms scheme — tentatively named Atal Distribution System Improvement Yojana (Aditya) — to cut electricity losses below 12 percent. The scheme aims to ensure continuous supply of power, adopting models such as privatising state-run DISCOMs, and promoting retail competition.

“The government has decided to waive off the fixed charges and interstate transmission charges (by Powergrid Corporation Limited) against the power to not draw from NTPC, DVC, and other CPSE from the period March 24 to May 17, 2020,” tweeted Power Minister R.K. Singh. This will amount to ₹0.22 per unit inter-state electricity transmission charges by Power Grid Corporation of India, resulting in potential savings of up to ₹1400 crores. Add this to the discounts gencos are expected to give to get early payments from the DISCOMs, and the ₹94,000 crores figure is neatly covered, for now.

Commenting on the liquidity infusion, Sabyasachi Majumdar, Group Head & Senior Vice President – Corporate Ratings, ICRA Ltd says, “The liquidity infusion of ₹900 billion is a significant positive for the IPPs impacted by the long delays in receiving payments from DISCOMs, with outstanding dues to power generation and transmission companies standing at around ₹940 billion. This is especially positive for renewable IPPs in the states of Andhra Pradesh, Rajasthan, Telangana, and Tamil Nadu, which are reeling under pending dues of 8-12 months from these state DISCOMs. This would enable the IPPs to lower their working capital interest burden in the near term and improve their liquidity and debt coverage position.”

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.