Climate Policy Initiative aiming to accelerate global economic growth

By EPR Magazine Editorial May 9, 2024 4:19 pm IST

By EPR Magazine Editorial May 9, 2024 4:19 pm IST

CPI is a leader in tracking sustainable investment trends, identifying innovative business models, and supporting solutions that can drive the transition to a low-carbon, climate-resilient economy.

Climate Policy Initiative (CPI) is focused on developing innovative finance and policy solutions that support credible, equitable green growth, and transition plans through its key areas. Vivek Sen and Manish Kumar spoke with EPR Magazine to share insight into the industry and the organisation.

How does the Climate Policy Initiative (CPI) leverage its expertise in finance and policy to drive economic growth while addressing climate change?

CPI is an analysis and advisory organisation with deep expertise in finance and policy. We aim to help governments, businesses, and financial institutions drive economic growth while addressing climate change and building a sustainable, resilient, inclusive global economy.

We analyse, design, and implement sustainable finance and development solutions and convene different stakeholders to help ensure collaboration for their adoption. Through this work, supports its partners in government, business, and finance to achieve their goals, reduce costs, and unlock investment. The desired outcomes include accelerating finance solutions to drive billions of dollars in investment in emerging markets and developing economies. Some outcomes include bringing clarity on progress of climate finance goals, driving energy access in the most underserved regions, and supporting policymakers and investors in energy finance. Also, some of the desired outcomes are reducing the cost of government support for renewable energy, helping governments assess the impacts of innovative aid approaches, and leveraging data science to deliver robust climate finance and policy insights.

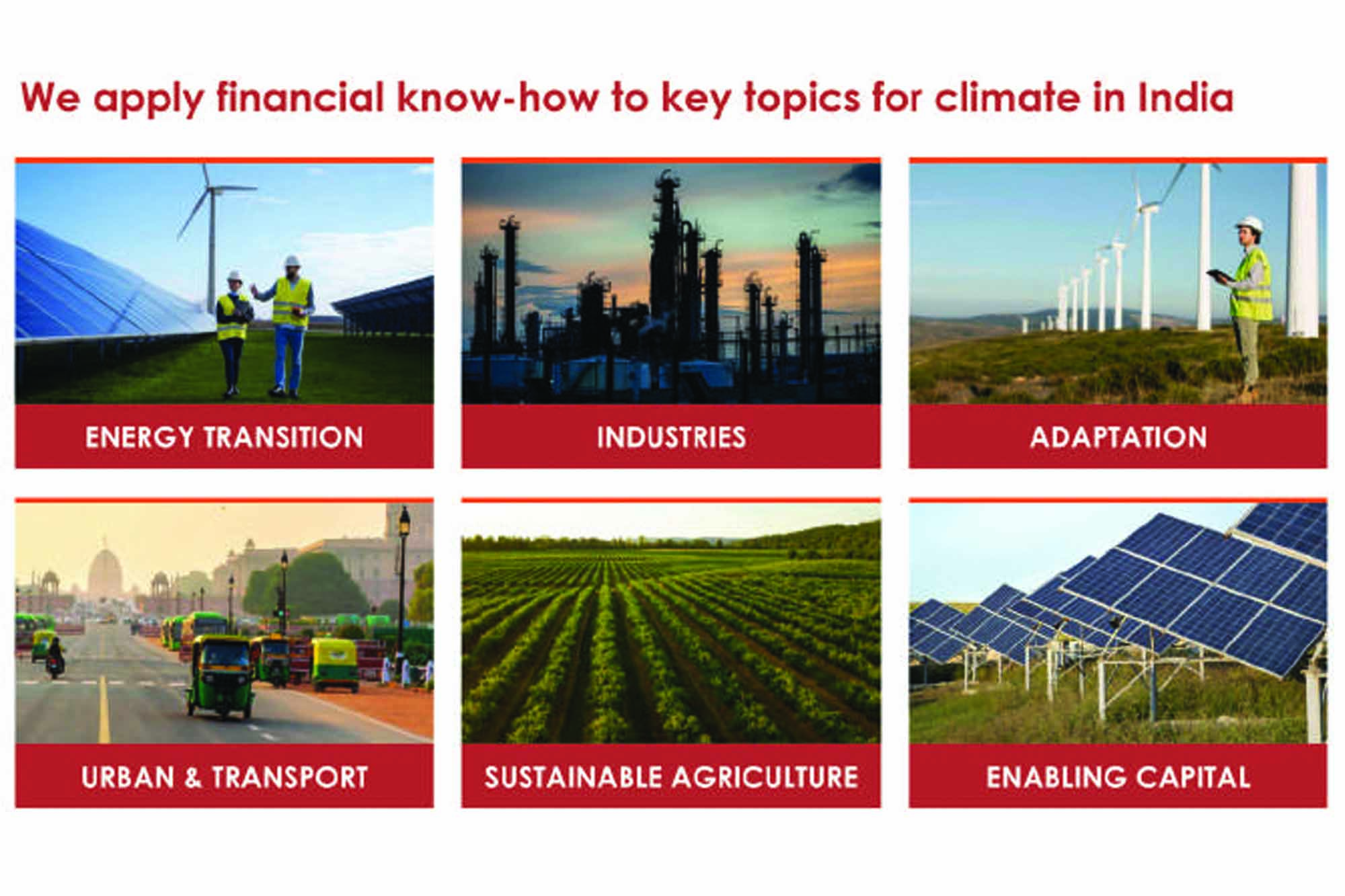

In India, CPI is focused on developing innovative finance and policy solutions that support credible, equitable green growth and transition plans through three key areas such as:

State of Finance and Policy:

CPI promotes understanding of the current state of climate finance and policy through meticulous tracking and mapping of finance flows. This includes assessing finance for climate adaptation in India, identifying green investment opportunities, and assessing sustainable finance requirements for various sectors, including energy, agriculture, and industrial decarbonisation.

Alignment and Effectiveness:

CPI aims to enhance alignment and effectiveness across various sectors via capacity-building initiatives. This includes efforts to strengthen the financial system’s green practices, implement green scoring mechanisms, define a taxonomy for sustainable finance, and develop frameworks to ensure optimal alignment of financial flows with climate-resilient objectives.

Design and Development:

CPI aims to facilitate a just energy transition and foster innovation through the design and development of CPI initiatives, including project preparatory facilities, the Global Innovation Lab (India Chapter), and the Just Energy Transition Framework. We also work in areas including low-carbon transitions for electricity and transport, designing blended finance and risk mitigation structures, and developing a robust carbon rating framework.

These strategic pillars form the foundation for their mission to accelerate the transition to net-zero and climate-resilient economics. CPI’s efforts efforts in convening and networking have also enabled them to inform policy and finance decisions while fostering invaluable partnerships and collaborations.

Can you provide specific examples of CPI’s services to governments, businesses, and financial institutions?

CPI India’s work on various innovative climate finance and policy solutions includes clean energy market catalysing initiatives such as India Clean Energy Finance and India PURE Finance Facility (IPFF), which support India’s clean energy mission. For example, IPFF aims to expand the productive use of renewable energy (PURE) in rural and semi-urban areas, particularly in low-income communities. Its innovative approach goes beyond the transition from fossil fuels, emphasising projects that bring additional benefits such as creating livelihood opportunities, promoting gender equity, and fostering social and economic growth. IPFF establishes and funds a robust network of technical advisory services to help existing and emerging PURE enterprises secure long-term financing from domestic and international financial institutions.

Capacity-building initiatives, such as the Center for Sustainable Finance (CSF), a knowledge-sharing and networking platform, help build the institutional capacity of financial institutions, policymakers, and regulators to accelerate the shift toward more sustainable development. The CSF supports this shift by creating a platform that enables open dialogue between stakeholders, shares best practices, provides research and analysis, informs policy-making and financial sector regulation, and capacity-building workshops.For example, the CSF released the “Financing Adaptation in India” report in 2024 in response to the growing urgency for policies that increase climate adaptation investment. Highlighting India’s approach to adaptation as a developmental strategy, this report estimates the adaptation investment needs and funding gaps faced by individual Indian states and explores ways to bridge these gaps. Also, the report estimates the analytical work for transitioning towards a sustainable energy future, such as on a futureproofing strategy for public sector undertakings and recommendations for a just energy transition.

What distinguishes CPI from other mission-driven organisations?

Since being founded in 2009, CPI has created a niche as an organisation that specialises in working at the intersection of policy and finance. We have successfully delivered several long-term, high-impact projects that are recognised globally.

CPI is a leader in tracking sustainable investment trends, identifying innovative business models, and supporting solutions that can drive the transition to a low-carbon, climate-resilient economy. We are unique in our focus on finance, ability to get the right people to the table, and analytical rigour. CPI gives policymakers, regulators, finance professionals, academia, and advocates the tools and guidance they need to provide bold leadership and implement ambitious action for more sustainable economic development.

CPI bridges the gaps from idea to implementation, identifying the possibilities in policy and finance that lead to sustainable, equitable, climate-resilient solutions. We do this through four pillars of our work:

Assess (Tracking and Mapping): Using data and tools that identify the current state of climate progress.

Improve (Alignment and Effectiveness): Using rigorous methodologies and analysis that create practical, defensible guidance.

Scale (Design and Development): Incubating transformative policy and finance models.

Bridge: Using convening and networking through leadership networks that are convened, educated, and activated.

How do Manish and Vivek approach sustainable energy transitions differently within their roles at CPI India?

Manish Kumar is a Senior Analyst at CPI India, based in Delhi. His work at CPI is focused on pathways and strategies for a low-carbon transformation in the energy and transportation sectors. Presently, he is engaged in research on a just transition in the energy sector and formulating financial models for zero-emission freight in India. With over seven years of experience in power sector research and consulting, Manish is proficient in power distribution, renewable energy, and technical feasibility studies.

Vivek Sen is an Associate Director of CPI India, based in Delhi, where his work focuses on transition finance. His expertise lies in energy, climate, power, transport, industries, and transition finance, with over 15 years of experience. Vivek leads the India chapter of the Global Innovation Lab for Climate Finance (the Lab) and has supported the development of the Lab’s Sustainable Energy Bonds and Loans4SME instruments.

Spokesperson: Vivek Sen, Associate Director, Manish Kumar, Senior Analyst

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.