APAR Leads Innovation in Power Transmission and Distribution Infrastructure with Cutting-Edge Conductor Technologies

By Staff Report August 1, 2025 5:40 pm IST

By Staff Report August 1, 2025 5:40 pm IST

The main strength of APAR’s products lies in their versatility. Whether it’s optimising electrical and thermal performance, ensuring durability in extreme conditions, or achieving cost-effectiveness, APAR’s solutions are designed to improve the reliability and efficiency of power transmission and distribution, and telecom networks.

Drawing on over six decades of excellence, at APAR, we act as architects, designing solutions for energy infrastructure that are both foundational and transformative — quietly driving progress while leaving a visible mark on industries and communities worldwide. Innovation lies at the heart of APAR’s value creation strategy, serving as the cornerstone of its long-term sustainability and growth. With a proven legacy of building scalable businesses and trusted brands, the firm has become an integral part of India’s growth story, supported by a diversified business model and strong operational and financial performance.

Role of APAR Industries in technological advancements

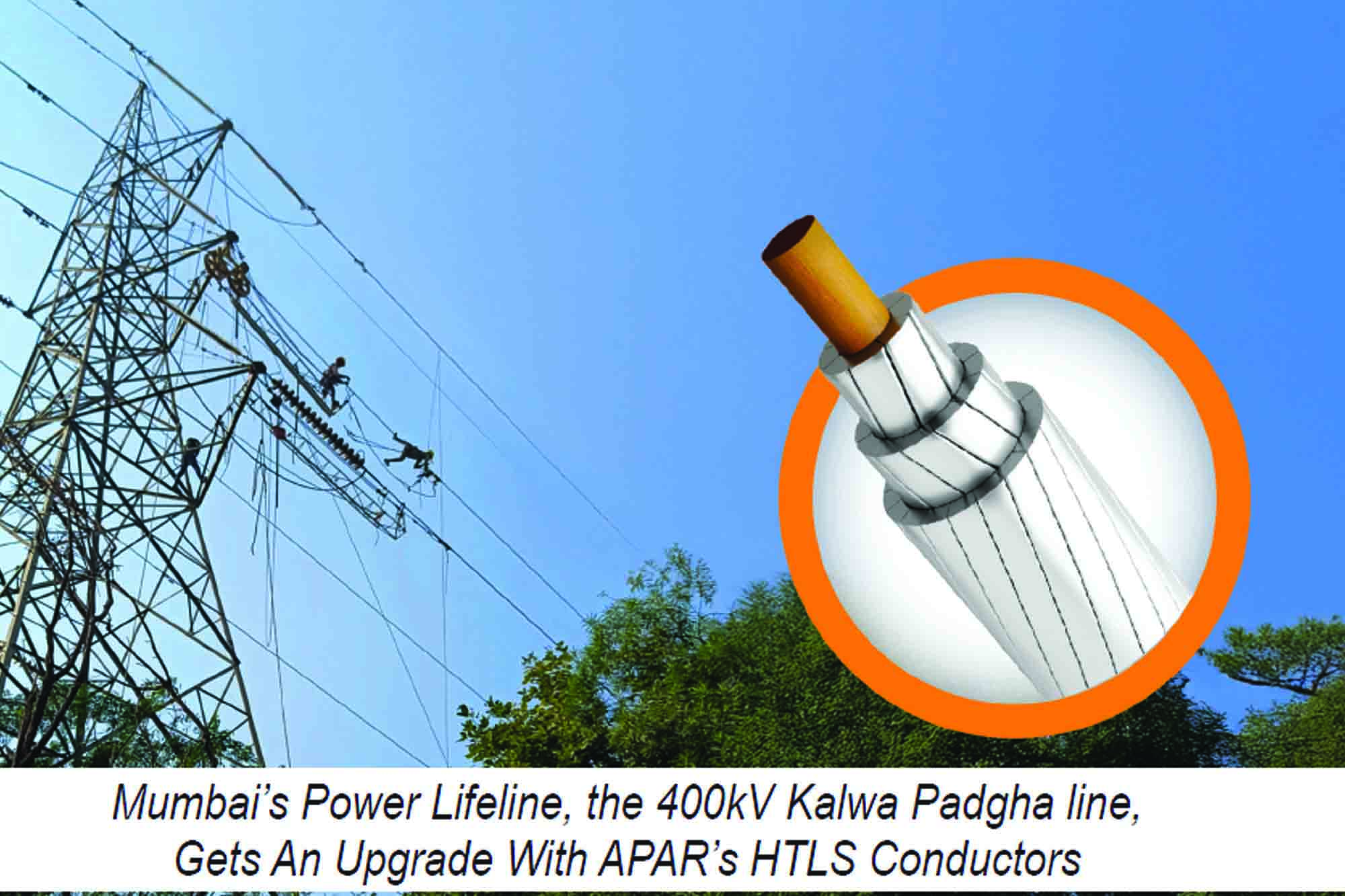

The Power Transmission and Distribution (T&D) value chain is witnessing notable technological advancements aimed at boosting grid efficiency, increasing capacity, and reducing energy losses. APAR Industries Ltd. is at the forefront of this revolution, playing a remarkable role in delivering advanced conductor technologies and integrated solutions that redefine modern transmission infrastructure. The comprehensive range of offerings by APARincludes Conventional Conductors, High-Performance Conductors (HPCs), High-Temperature Low-Sag (HTLS) Conductors, High Efficiency Low Loss Covered Conductors, Continuous Transposed Conductors (CTCs), EHV Cabling, Optical Phase Conductors (OPPC), Coated Conductors and Specialised Turnkey Solutions that are engineered to enhance ampacity, reduce losses and extend the lifespan of transmission and telecom networks.

APAR’s HTLS reconductoring work (33kV to 400kV) spans over 210 turnkeyreconductoring projects. The firm has supplied more than 63,000 km of conductors, completing a line length of over 5,400 km, as well as carried out augmentation for 95 substations. APAR also provides a wide range of T&D conductors customised to suit specific needs, offering options such as round, trapezoidal, and Z-shaped wire profiles, as well as concentric-lay stranded conductors (with up to 127 strands). Additionally, it offers different surface finishes such as specular or non-specular (dull) finishes, to minimise glare and meet operational and environmental demands.

For distribution networks, APAR provides a range of conductors, including AAC, AAAC, ACSR, OPGW, and Medium-Voltage Covered Conductors (MVCC), which enhance safety, increase line lifespan, and reduce maintenance needs, especially in challenging areas such as urban environments, coastal regions, and high-altitude zones. About OPGW live line reconductoring and telecom integration works (ranging from 33kV to 765kV), the firm has delivered over 48,200 km of conductors, installed more than 24,100 km of OPGW and successfully completed over 140 telecom integrations.

The main strength of APAR’s products lies in their versatility.Whether it is optimising electrical and thermal performance, ensuring durability in extreme conditions, or achieving cost-effectiveness, the solutions are designed to improve the reliability and efficiency of power transmission and distribution, as well as telecom networks. Through its commitment to R&D and innovation, APAR is not only enhancing performance but also contributing to the reduction of carbon emissions and ensuring long-term and cleaner solutions for the energy sector.

APAR has pioneered the development of:

Advanced conductor designs, such as POWER-ZAD, feature Z-shaped interlocked wires. Provides superior aerodynamics and reliability that prevents power line collapse during extreme weather conditions.

Twisted pair conductors, which are designed for specialised uses that provide robust and long-lasting solutions for high-tension applications and harsh environments.

Ultra-low-sag (ULS) conductors, which are ideal for transferring 400kV equivalent power on a 220kV network.

Composite core conductors (in collaboration with CTC Global, USA) that offer higher conductivity, better power transfer and lower power losses, particularly in 11kV to 33kV sub-transmission and distribution lines.

KTAL alloy conductors that can operate up to150°C without deterioration, improved strength-to-weight ratios and reduced wind load on towers, making them suitable for large-crossing sections in mountainous and hilly terrains.

Ultra-high-strength aluminium-clad steel wires, which offer superior durability, ensuring optimal performance under high loads and improving line reliability.

Low-loss ACSR (LL-ACSR) conductors that provide a significant reduction in transmission losses compared to traditional ACSR conductors. By minimising magnetic and ohmic losses, while also lowering CO2 emissions, these conductors support a more efficient and environmentally friendly energy transmission system.

Cu-Ag contact and Cu-Mg catenary wires which are high-capacity wires for railways, metro and bullet trains.

Conductors with high emissivity characteristics allow it to operate at lower temperatures. This design maximises thermal capacity, reducing electrical losses and minimising capital investment.

OPGW 144/288F and optical phased conductor (OPPC) technologies that combine power transmission with data capabilities that enable real-time monitoring and support smart cities, 5G and IoT infrastructure.

These technological shifts, which align with APAR’s commitment to sustainability and resilience, are redefining the role of conductors in building modern, efficient, and future-ready power networks.

APAR’s leadership in this transformation underscores its critical contribution to industry-wide evolution.Challenges and opportunities

Significant opportunities are emerging in the global transmission and distribution (T&D) market, which is expected to grow at a CAGR of 6-7 per cent over the next five years.

On a global scale, the push towards decarbonising power generation is accelerating, driven by global climate goals and the growing adoption of renewable energy sources. Renewables are expected to contribute nearly 50 percent of the world’s electricity supply by 2030. According to the International Energy Agency (IEA), to meet net-zero emissions targets, investments in clean energy must reach $4.5 trillion by 2030. Additionally, approximately 50 million miles of transmission lines will need to be added or replaced within the next 17 years to achieve these climate objectives and ensure long-term energy security.

This expansion, which is on par with the current global grid’s size, will require over $600 billion in annual investments by 2030, doubling the present levels. Transmission infrastructure plays a crucial role in connecting renewable energy sources, such as the 1,500 GW of clean energy projects awaiting grid access worldwide, and in addressing power transmission bottlenecks. Countries like India are leading the charge, making substantial investments in green energy corridors, large-scale solar farms and wind power zones, all while aiming to achieve 500 GW of renewable capacity by 2030.

More so, the One Sun, One World, One Grid (OSOWOG) initiative represents a pivotal step toward a more interconnected global energy system. By facilitating cross-border renewable energy exchanges, OSOWOG is expected to drive demand for HVDC connections, advanced interconnection systems and regional grid upgrades. In addition, international grid connections are being explored to capitalise on global time differences, optimising energy distribution across continents, while leveraging digitisation to enhance grid management and efficiency.

Together, these trends —digitised asset management, renewable-driven grid expansion, and global-scale power sharing — create a compelling roadmap for T&D evolution, poised to make energy more reliable, efficient, and globally interconnected. This leads to the creation of enormous opportunities for component/equipment suppliers, as well as EPC players.

The market is experiencing some challenges domestically, which are impacting the business, like:

–Delay in getting approvals for power shutdown, impacting their conductoring projects

–Right of Way (ROW) challenges

–Availability of 24*7 supply of quality power to manufacturing facilities, e.g, in Silvassa, Odisha

–Slower adoption of new and greener products and solutions

Furthermore, the Government of India has set an ambitious goal of reaching $1 trillion in merchandise exports by 2030, and the power sector is playing a crucial role in achieving this goal. However, the sector is confronted with several challenges as it navigates the ever-changing global trade environment that includes:

Diminishing export incentives: Reduced export incentives make it increasingly difficult to compete with countries such as China, Europe, the Americas, Africa, and Australia, where manufacturers benefit from more robust support. Besides, ongoing tariff wars and trade tensions are creating significant uncertainty that increases export costs and affects competitiveness in international markets.

These factors require us to continuously innovate, improve operational efficiency and collaborate closely with the stakeholder ecosystem to address the challenges effectively.

***********************

Authored by:

Manish Agrawal, CEO- Conductors and Telecom Businesses, APAR Industries Limited; MD- APAR T&D Projects Pvt Ltd

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.