Medium and low voltage switchgear market on the rise

By EPR Magazine Editorial March 28, 2020 11:32 am IST

By EPR Magazine Editorial March 28, 2020 11:32 am IST

Leading industry players come together to discuss the potential growth for the switchgear market in the MV and LV segment.

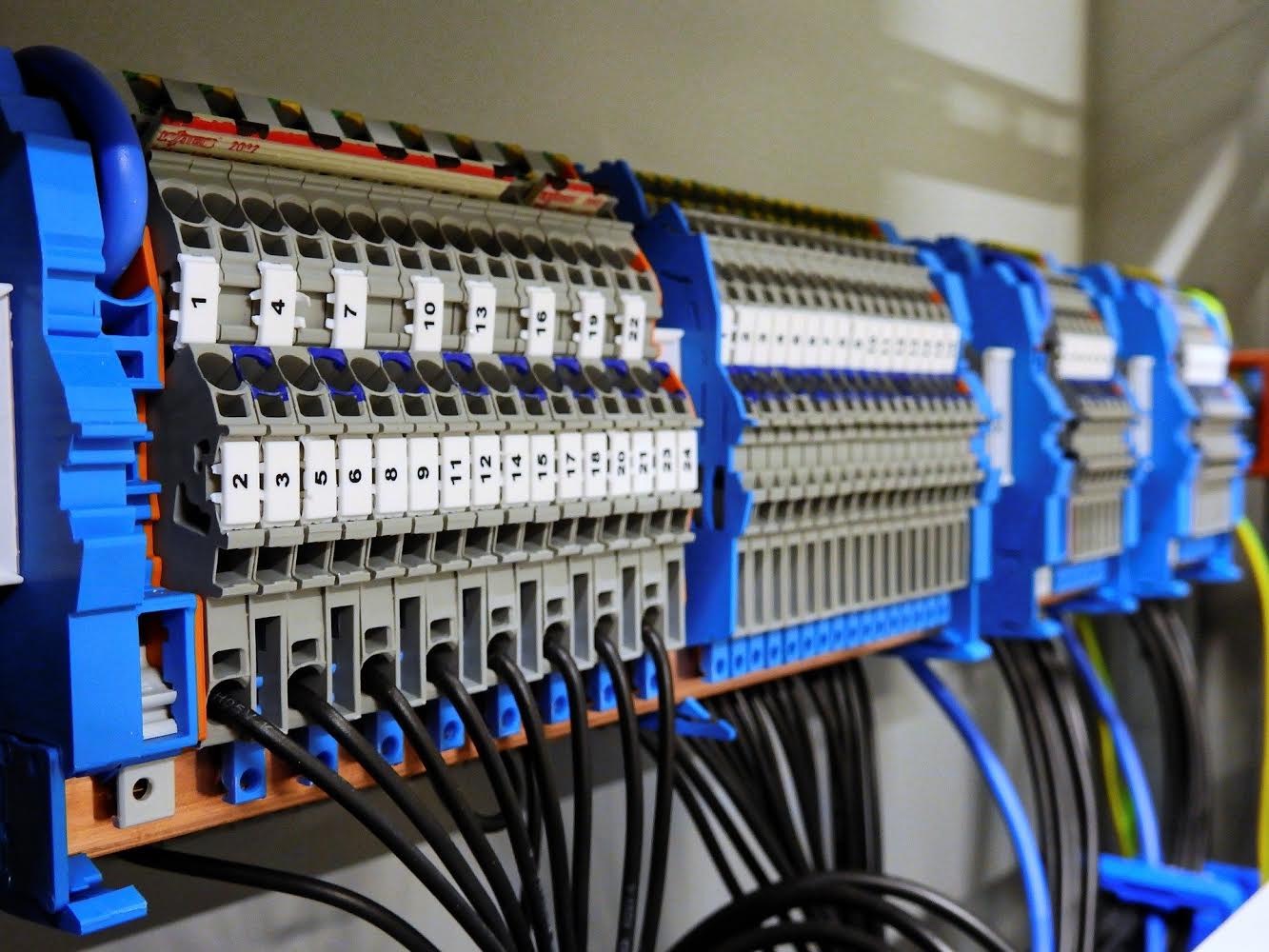

The switchgear market in India is projected to grow at a CAGR of over 15 percent through 2023. Low voltage switchgears are dominating the Indian market with wide applications in commercial, residential buildings, real estate industry, and construction sector, and this trend is expected to continue for the foreseeable future. At the same time, the medium voltage switchgear market has witnessed stagnant growth. We look at the underlying causes of these market developments and how the segment can be strengthened further.

Factors driving growth of the MV and LV switchgear market

The projected growth of over 15 percent through 2023 in India’s switchgear market as mentioned above is primarily due to the rapid development across residential, commercial and industrial sectors in the country. Gautam Seth, Joint Managing Director, HPL Electric & Power Ltd. said, “There are large electrification programmes running across the country and major resources are being spent to upgrade the existing transmission and distribution networks, thereby fuelling growth in India’s switchgear market.”

There are many other important aspects driving the growth of the MV and LV switchgear market in India. Government initiatives such as rural electrification through the Pradhan Mantri Sahaj Bijli Har Ghar Yojana, the Pradhan Mantri Awas Yojana and the push for smart city development across India have really helped. Kunal Nandu, Director, Vinay Electrical Solutions opines, “Upgradation of existing power generation and distribution facilities as well as creation of new capacity has also tremendously boosted the demand for MV and LV switchgears.”

Highest demand in Asia Pacific for switchgears

Asia Pacific is a very large and emerging market for switchgears, as many nations in the region are upgrading their transmission and distribution networks. The region has been witnessing the highest demand for switchgears primarily due to the major developments in power transmission and distribution networks in densely populated countries such as Japan, China, and India. In 2018, the switchgears market in Asia Pacific was valued at $44.30 billion and is expected to grow further at a very healthy rate in the coming years.

Seth said, “HPL Electric and Power Ltd. is a major player in India in the switchgear segment with a large portfolio of products catering to various segments. We have been actively exporting our switchgears not only in the Asia Pacific region but across the whole world. Our products are world-class and comply with various international standards and also meet the stringent demands of energy efficiency, longevity, and quality.”

Challenges in the switchgear marketMoreover, coronavirus has been having a huge impact on the manufacturing and availability of switchgears. Nandu adds that coronavirus has been declared a global pandemic. At the moment, public health and safety is most important. He says, “If you look at the impact on our industry, supply chains across the globe have taken a hit. In lieu of that, costs have shot up because of the induced shortages. Hopefully, the effects will be short-term in nature and we shall bounce back in 5-6 months with a vengeance.”

Regulatory boost from government for targeted growth

For every industry to function at an optimum level, work at full capacity and bring prosperity to the people that operate in it, a push and a fallback support mechanism from the government is required. Nandu concludes, “What will really help is to have a subsidised cost of compliance to compete globally with the best of the best brands. Indian companies like us are more than capable of delivering the best-in-class products to the world. The government must also take necessary initiatives to create more awareness about these products as they are directly related to safety. We would also like to see swift and on-point implementation of government initiatives. One of the core areas where our industry lags behind is having a government-backed programme for developing skilled labour and filling the need versus capability gap.”

Gautam Seth, Joint Managing Director, HPL Electric & Power Ltd.

Major resources are being spent to upgrade the existing transmission and distribution networks, thereby fuelling growth in India’s switchgear market.

Kunal Nandu, Director, Vinay Electrical Solutions

What will really help is to have a subsidised cost of compliance to compete globally with the best of the best brands.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.