Deployment of T&M instrument to boost digital transition

By EPR Magazine Editorial December 15, 2021 12:36 pm IST

By EPR Magazine Editorial December 15, 2021 12:36 pm IST

Growing need for communication tests and measurement equipment is set to witness a significant growth in test and measurement market.

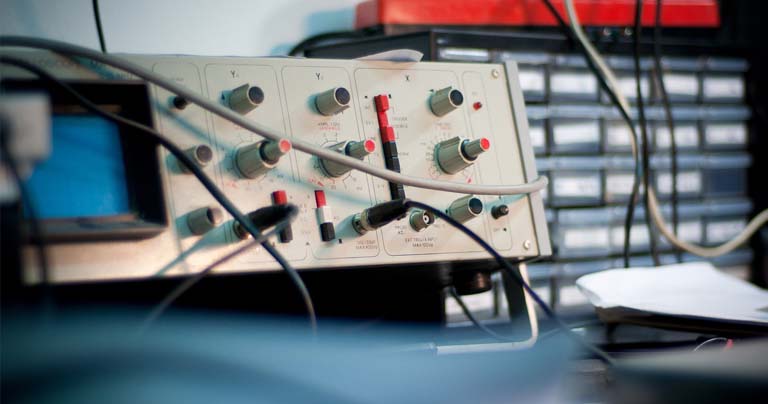

The Test and Measurement Equipment market is forecasted to reach $33 billion by 2025 and is estimated to grow at a CAGR of 4.05 percent by 2025. The ongoing digital transformation in automotive industry is boosting the retrofitting of devices and equipment embedded with a wide range of test and measurement equipment such as electrical tester, digital multi-meters, digital oscilloscope, spectrum analyser, and environmental testers. Data centres, advanced telecom infrastructure, and automotives are some major end-use applications that require advanced measuring equipment to meet modern testing requirement. The data centres utilise various complex electronics devices and thus a large number of test and measurement equipment are deployed in these data center to monitor device condition, signal strength, and data transmission condition.

Key takeaways

Analysis by industry vertical

The test and measurement equipment market is poised to grow at a rapid pace owing to wide range of applications in the automotive sector. According to next green car report, UK had 220,000 plug-in cars in the coming years. These included both hybrids and fully-electric vehicles. The growing adoption of electric and hybrid vehicles and the emerging demand for autonomous vehicles is likely to accelerate the market growth during the forecast period. Most of the autonomous vehicle use wireless communications standards such as long term evolution (LTE) and Wi-Fi for their infotainment system and other automobile accessories. By 2020, about 150 million vehicles were to be connected via Wi-Fi, and 60-75 percent of them will be capable of consuming, creating, and sharing Web-based data. These modern electronic devices in automobiles are boosting the need of RF testing equipment (Radio Frequency testing equipment) significantly.

T&M market segment analysis – by geography

The Asia Pacific is the largest region for the test and measurement market due to presence of strong manufacturing base. Most of the demand from APAC region is experienced from China India, Taiwan, and Japan due to growth in electronics and automotive industry. China’s National Bureau of Statistics estimated the sale of consumer goods up by 9.2 percent in 2018 than the previous, which values up to approximately $1,436.8 billion. Similarly, within APAC, India started producing wide range of electronic products under major standards with latest government initiatives such as T&M India. According to the Department of Electronics and Information Technology (DeitY), approximately 2,000 chips are being designed every year in India. Under the initiative of Make in India campaign, India is likely to see an investment of $1.5 billion in electronics sector during 2018-2020. Expansion of these new plants is likely to bring rapid growth for test and measurement equipment in the country. Asia Pacific is set to grow at a CAGR of 5.2 percent during 2025.

The demand for test and measurement equipment from APAC region is growing enormously in telecommunication sector. Countries having dense population such as India and China contribute large market for telecommunication industry. For instance, in India number of mobile phone subscribers was 91.11 (per 100 inhabitants) in 2017 but in 2018, the number raised to 91.51. The number is likely to increase due to improvement in telecom infrastructure in the country. Growing need for communication tests and measurement equipment is set to witness a significant growth in test and measurement market owing to increase in communication infrastructure.

Market drivers

Development of communication infrastructure coupled with rising popularity of IoT based technology

Testing and measurement of equipment, devices, and signals are the integral part of communication network. Thus, any new development in communication network will have a positive impact on testing and measuring equipment market. Presently, communication industry is witnessing several transformations due to evolution of 5G technology and data centres. In 2019, Bharati Airtel has announced to invest approximately $8 billion by 2022 towards building 5G infrastructure and 4G expansion. Similarly, in 2019, Vodafone has prepared its road plan to invest approximately $3.08 billion in next 15 years to expand its network. It has tied up with Ericson to deploy 5G ready devices into these newly expanded networks. These new investments are expected to bring more opportunity for test and measurement market.Increasing demand from power management and consumer electronics application

Power sequencing and power supplies are few of the major power management applications that are augmenting the need of electronic test equipment. Similarly, the growing design complexity of modern consumer electronics is augmenting the need for precision testing equipment. For instance, in power management and consumer electronics applications, 8-bit oscilloscope was used traditionally. However, with strict margins for design, the engineers are now looking for high resolution oscilloscope with analogto-digital converters (ADC) and high number of bits. These new applications are creating opportunities for advanced test and measurement equipment.

Market challenges

Designing challenge coupled with high cost

With the growing advancement in electronic device, systems are moving towards a complex setup which needs advance test and measurement equipment too. This leads to development of multi-functional test and measurement equipment. Manufacturers are facing both designing and cost challenge to meet the emerging need of end users. As per major electronic instrument manufacturers the cost of a modern network analyzer has increased by 15-20 percent due to the use of advanced and expensive component.

Market landscape

The major players in the test and measurement market include Bureau Veritas, Danaher, Keysight, SGS, Thermo Fisher, Texas Instruments Incorporated, XSENSOR Technology and other. Thus, major vendors are looking forward to consolidate this market through merger and acquisition. While expertise and economy of scale is the key strength for major vendors, small vendors will optimise the supply chain to reduce the operational cost.

Partnerships/mergers/acquisitions:

Market research scope

The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Test and Measurement Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of Test and Measurement Market, and their specific applications in the consumer electronics, industrial, medical, and security and surveillance sectors.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.